Private Lending through Heritage Home Buyers

Watch this video to learn how to earn a 10% annualized return on your investment capital backed by Real Estate

Joseph Waters

Owner of HHB

About Us

Heritage Home Buyers is a real estate investment company based out of Enterprise, AL. We are one of the top Wiregrass real estate investing teams because we love the communities we work in.

Locally owned by Joseph Waters, the company has been investing in real estate for 6+ consecutive years. Heritage Home Buyers has been in operation for 2 years specializing in direct to seller marketing and off market acquisitions in the Wiregrass area.

Heritage Home Buyers owns and manages a rental portfolio of 50 doors and growing. We have an in-house construction team that is actively renovating between 5-10 homes at any given time.

Thanks to our professional team Heritage Home Buyers has purchased, sold and partnered on 100+ homes since 2021.

The Process

Why Invest with Heritage Home Buyers

Secure and Safe

Your Money is Secure and Safe backed by real property.

No Volatility!

Your Principle Remains the Same and You Earn a Reliable and Certain Return, Unlike the Stock Market!

Return Principal Easily

You Can Get Your Principal Back in Case of Emergency

10% Annualized Return!

No other investment opportunity like this!

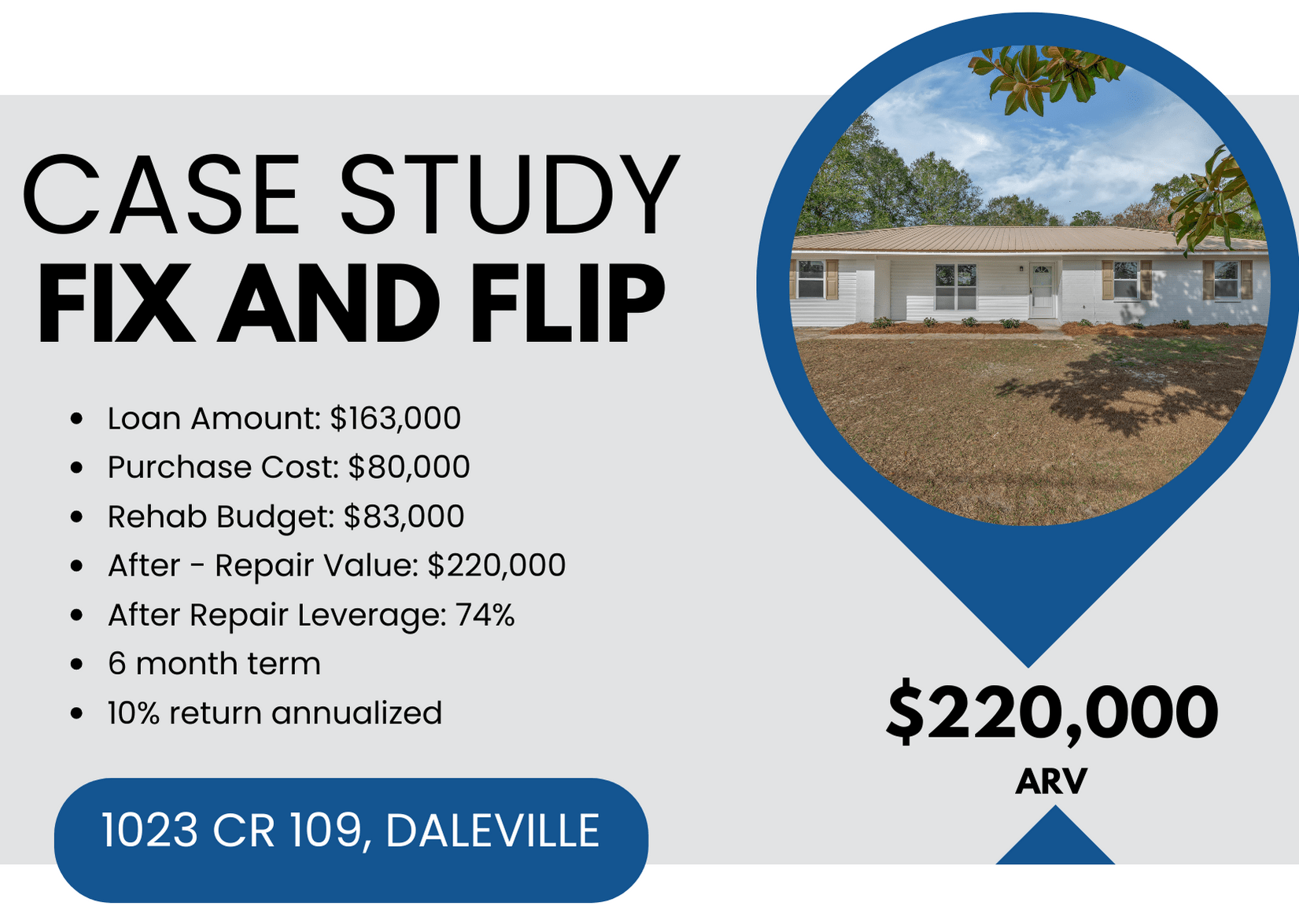

See just one of our fix & flip cases

FAQs

YES!

You bet you can. Absolutely. In fact, it’s a great use for them and what better way to go than tax deferred or in the case of a ROTH IRA, tax free. If it’s your IRA it must be self-directed. Now this is easy to accomplish and it’s only a matter of moving it to an administrator of your choice. I recommend Equity Trust located in Eleria, Ohio. They’ve been around a long time. I have contact information for that company so you can talk to them directly.

They have thousands and thousands of IRAs and I think you’re going to find them a pleasure to deal with. Now don’t worry, this is not a roll-over with penalties from the IRS. It’s merely a transfer from your current administrator to another one. With Equity Trust you will be able to do whatever you want with your money. Not what someone else insists you to do.

Now, if you have left a job or retired with a 401K, that 401K belongs to you and you can transfer it to Equity Trust and then you can start making private loans and truly start self-directing it.

I know several lenders that take the money out of their private plan and shift it into their own self-directed IRAs. You might want to consider the same if it applies to your circumstances and if your company plan doesn’t have a history of a high rate of return that you’re happy with.

The answer is yes and no. Technically any debt instrument is a security. But it’s not a security that you’re going to need a license for or have to register with the SEC or anything of that nature. You will own the whole loan with no other participants. You are in control all the way which in itself makes this a better investment than any other vehicle that I know. Only when loans are pooled does it become a security.

Well, it won’t be me and it won’t be you. You should never write a check directly to me or my company. All real estate closings should be done by a real estate attorney. Your check will be made out directly to the closing attorney for the gross amount of the loan. All closing costs will be paid by me. This is standard procedure… Just like any other loan done from anywhere regardless of who the lender is. It then becomes the Real Estate Attorney’s responsibility to receive your funds and make sure that all the documents are in place to secure your investment. You don’t do any paperwork, you simply agree to make the loan and get the money to the Real Estate Attorney when it’s time.

First of all, I purchase title insurance as part of the closing costs on all purchases to insure we have a clear and clean deed. And it will be issued naming you, the lender, as the insured. This protects you against title defects which could affect your collateral. Plus, I purchase fire insurance as part of the closing costs. I want the fire insurance company naming you, the lender, right on the policy so if the house burns down you get a check for the full amount of your loan. Now when you receive your package after the closing it will contain the original note and a copy of the deed of trust which will be recorded at the court house. Again, the Real Estate Attorney represents you and makes all this easy for you and ensures proper execution.

Well, that’s up to you and me. Most loans are interest only and range from one year to three year balloons with all the principle due. However, this can be arranged any way you want it arranged. It comes down to whatever it takes to meet your investment needs and your investment plan. Of course, the longer the money stays out at a higher rate of return the faster it’s going to grow. If it’s interest only, you’re earning interest on the entire principle all the time. If you get a little piece of the principle every month on an amortized loan that little piece is no longer receiving a higher rate of return. So most of my private lenders like to keep the money out and collect interest only or have it accrue interest.

If you apply common sense and don’t break the rules I have in place to protect you, it’s as safe as any other high yield investment and a whole lot safer than most. In fact, in my opinion, it’s a lot safer than the stock market. Think about it. With stocks you’re betting on companies you know little about and the volatility of the market is out of your control. You can do well one year and get wiped out the next. Every day you’re wondering whether you’re gaining or losing and the only choice you get to make is when to buy or when to sell. Now that’s risky. I don’t care how good you are, the fact remains…you don’t get to make the rules in the stock market. Your investment is at the mercy of ever changing circumstances.

Heritage Home Buyers. All Rights Reserved.